Will I need GAP Insurance?

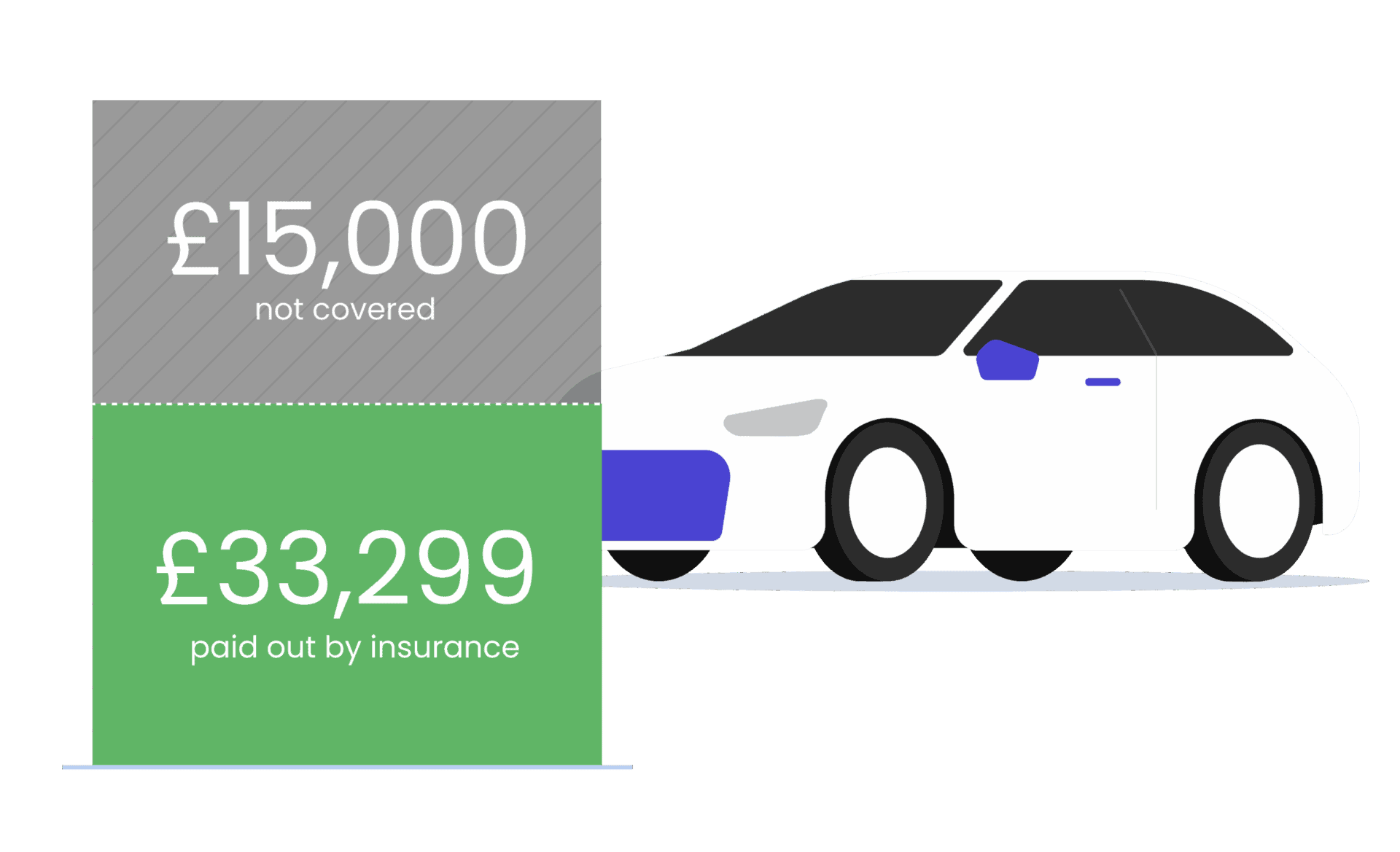

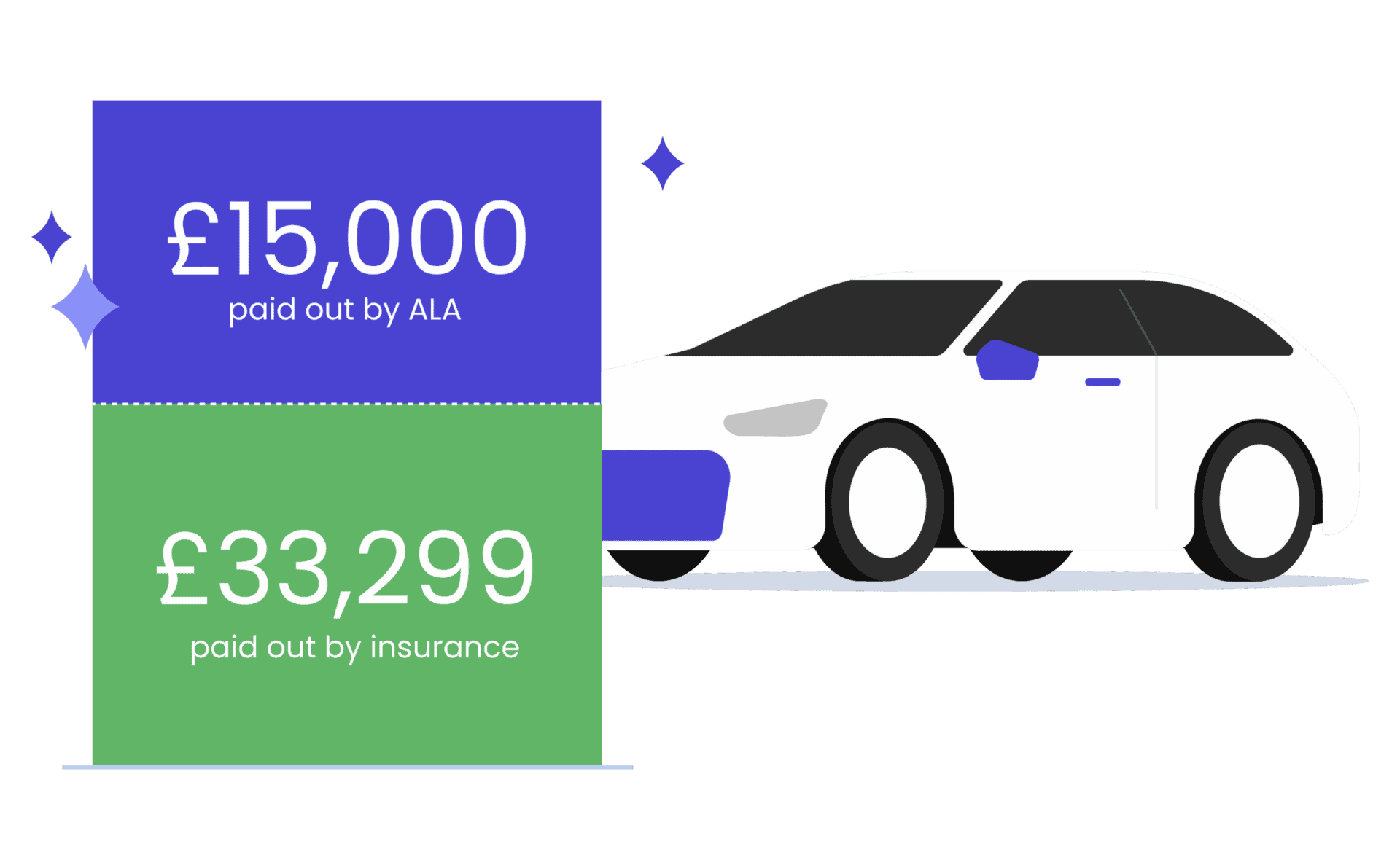

Over 1/3 of UK drivers have written off a car at least once (ALA, 2025), with 1 out of 5 having done so in the past 5 years (ALA, 2022). GAP insurance tops up your total loss settlement, making it easier to afford a replacement. The decision on whether to get GAP insurance depends on how prepared you are to deal with the financial consequences of writing off a car. Half of drivers say they would struggle financially after a total loss, making GAP insurance a good idea.

Discover whether GAP insurance is worth it for your vehicle

Find out more