ALA Money Survey 2023: Over a third of the UK don’t feel comfortable discussing their finances with friends

5 September 2023

| 7 mins

For many of us, money is something that’s often at the front of our mind. And with the cost of living getting higher and higher, it’s something that can be a big worry. Rising costs can cause us to reprioritise our outgoings, cutting back on discretionary expenses to manage our budget more effectively.

It’s no secret that feelings around money are heightened. That’s why, here at ALA Insurance, we wanted to find out exactly how comfortable people are in their financial situation. We also wanted to understand how these feelings affect our attitude to insurance, whether that’s for general insurance policies for homes and cars, or other helpful policies like additional car cover and excess protection insurance.

The ALA Money Survey 2023 surveyed over 2,000 people across the UK to learn more about their feelings towards money and their insurance. From how we talk about finances to friends, to whether we feel insurance costs are worth it once we claim, we want to get a sense of our collective attitudes.

How comfortable are we discussing finances?

Here in the UK, talking about money is often considered a taboo. Money can be a big worry for many of us, so why don’t we want to talk about that with our friends and family?

According to our survey, more than a third of the UK wouldn’t feel comfortable talking about their finances with friends.

This figure is much higher amongst older age groups, with half of those aged 65 and over claiming they wouldn’t feel comfortable discussing their finances with friends. By contrast, almost two thirds of 25-34 year olds said they would feel comfortable opening up and discussing their financial situation.

This differs from region to region too. Over half of those in Sheffield claimed that they also wouldn’t feel comfortable talking about finances making them the least likely in the UK to openly discuss personal finances. In contrast Birmingham residents felt the most comfortable, with over half saying they’d be fine with this conversion.

Top 5 UK Cities Most Comfortable Discussing Personal Finances

- Birmingham

- London

- Bristol

- Southampton

- Nottingham and Manchester

Top 5 Regions Least Comfortable Discussing Personal Finances

- Sheffield

- Norwich

- Edinburgh

- Newcastle

- Glasgow

Where London, Bristol and Southampton have some of the highest salaries in the UK and are among those most comfortable discussing finances, Edinburgh also has one of the highest salaries but is among the least comfortable. Similarly, Nottingham is the city

with the lowest salaries but is still comfortable discussing money.

How do we prioritise insurance?

Insurance is arguably one of the most important expenses as it offers protection against unforeseen events and potential financial hardships. However we know that for some, being able to afford insurance in the first place isn’t always easy and unfortunately, it can come with some worries.

Our survey found that despite the rising cost of living 9/10 of us view insurance as an important factor on their list of financial priorities. In fact, 40% said they were most likely to put insurance in their top 2-3 priorities.

Surprisingly, younger respondents prioritise insurance more, with almost a quarter of 25-34 year olds putting insurance as their most important financial priority. Older age groups are less likely to view insurance as a top priority, with just 7% of those aged 55 and over claiming it to be their most important financial priority.

Those most feeling the pinch it seems are prioritising protecting their assets the most. Lower-income households are more likely to view insurance at the top of the list, with a third of households earning less than £10,000 per annum claiming that insurance is their top financial priority. Similarly, 1 in 5 households that earned between £10,000- £20,000 per annum said that insurance was their top priority.

Those living in Bristol and Glasgow are most likely to view insurance at the top of the list, with 1 in 5 in both cities claiming insurance is their most important financial priority. In contrast, over 1 in 6 of those living in Newcastle say that insurance is low down on their list of financial priorities.

Why do we stop insurance policies?

Despite its importance, sometimes we must make the decision to stop an insurance policy. Whether we can no longer afford it or we don’t feel like it’s worth it, there are many factors that can affect our decision.

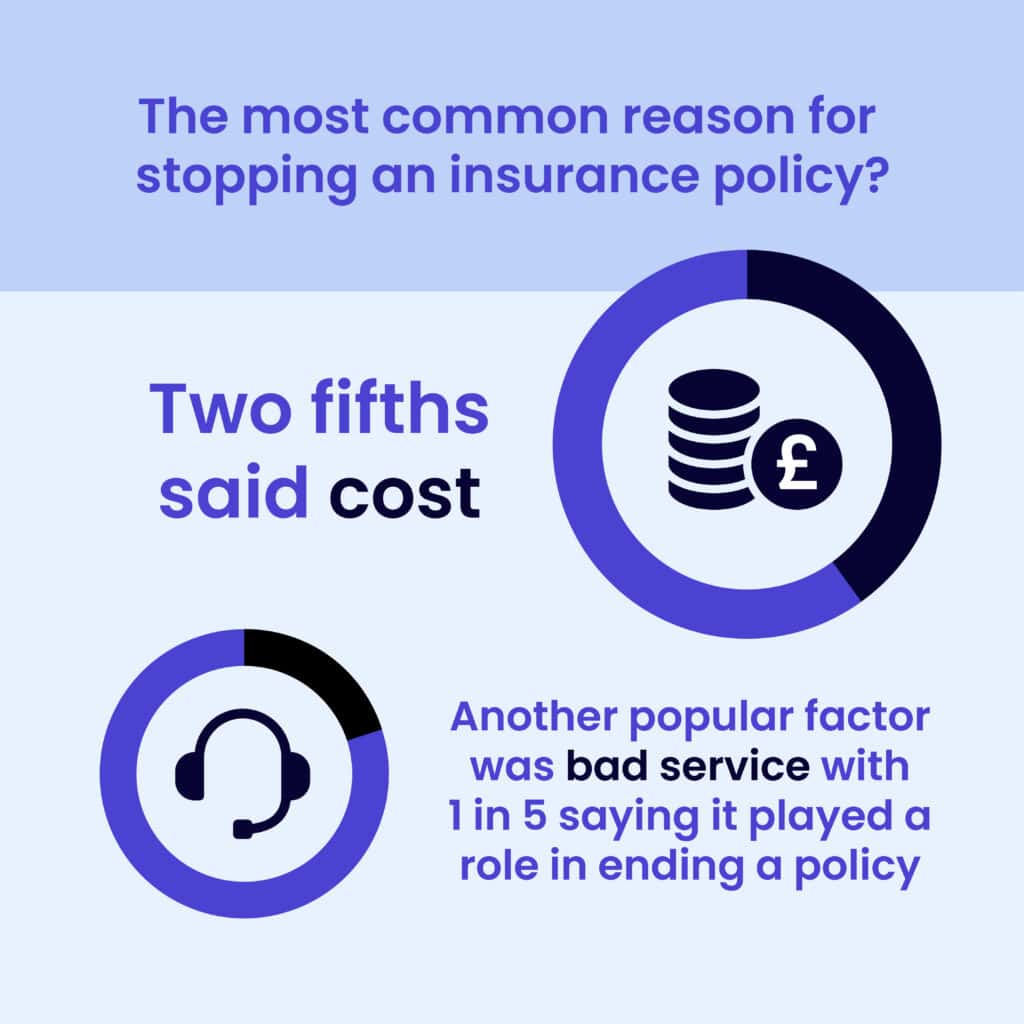

Our survey found that the most common reason for stopping an insurance policy is cost, with two fifths saying cost played a role in their decision. Another popular factor was bad service, with 1 in 5 respondents saying poor customer service played a role in them ending an insurance policy.

Customer service appears to be of greater importance to younger age groups, with more than a third of 25-34 year olds claiming to have ended an insurance policy due to poor customer service. By comparison, just 2% of those aged 65 and over ended an insurance policy due to poor customer service.

Cost is of greater importance to older age groups, with half of those aged 65 and over saying they’ve ended an insurance policy as a result. .

Do we feel like insurance policies are worth it once we’ve claimed?

Insurance revolves around lots of ‘what-ifs’, which can make it difficult to judge its value. That’s why we decided to ask our respondents just how valuable they found their insurance policy after they claimed.

Over half of those who claimed on insurance in the last three years felt it was worth it. This figure is higher amongst younger age groups, with over a third of those aged between 18-24 feeling that their claim was worth it.

As for the amount of people who have claimed on an insurance policy in the past three years, this was half of all respondents. While the other 50% have never made a claim.

Since the chances of claiming are high, it’s no wonder that insurance can be a worry for us.

But how does this affect our attitudes to car insurance in particular and how secure do we really feel?

How do we feel about car insurance?

Cars are a major expense for many of us and it’s crucial to secure the right amount of cover for your needs and protection. From mandatory general insurance to other important policies such as GAP, minor damage insurance and alloy wheel insurance, it’s vital to get these policies in order.

But with great importance can sometimes come with great worry. So we wanted to learn exactly how people feel about car insurance.

Overall, the survey found that around 9 in 10 worry about the cost of car insurance either regularly or some of the time. While over two fifths only worry about the cost of car insurance at renewal time a significant 1 in 8 worry about the cost of car insurance all the time.

Perhaps unsurprisingly, this figure is much higher amongst lower-income households, with over a quarter of households earning less than £10,000 per annum claiming to worry about the cost of car insurance all the time.

As for location, 1 in 5 of those living in Bristol say they worry about the cost of car insurance all the time. Liverpool on the other hand, are least likely to worry about the cost of their car insurance, with 1 in 6 Liverpudlians claiming they never worry about this.

Do we feel secure in our car insurance?

Despite now paying considerably more for mandatory car insurance, it appears that drivers are still left feeling dissatisfied with the coverage provided by their insurers. In fact, 1 in 10 say they do not feel secure in the level of coverage they have with the current car insurance provider.

Younger age groups in particular feel the least secure in their coverage, with around 1 in 5 of those aged under 34 claiming they don’t feel secure in their current policy.

Unfortunately, this feeling may be justified too, as previous data from ALA revealed that collectively, UK motorists lose £8.6 billion on claims without GAP Insurance as complaints around payout delays and the devaluing of vehicles are some of the most common concerns for drivers.

How can ALA, as insurance providers, help ease our customers’ financial worries?

We know how that insurance plays a big part in most people’s lives. That’s why at ALA, we believe it’s our duty to not only offer comprehensive coverage, but to foster a feeling of ease and assurance with the policies we offer.

We want to make sure that every customer feels comfortable and confident in the protection they receive. By offering full transparency, we strive to simplify the complexities of insurance, making every detail of a policy clear and accessible. We want to help our customers make informed decisions and to trust that we have their best interests at heart.

We know how stressful claiming on your insurance can be. That’s why any ALA GAP insurance customer who has experienced a total loss claim will be eligible for free therapy sessions at no extra cost to the customer and nothing added to our premiums.

To find out more, read more about our ethos or view the insurance policies we offer.