ALA Money Survey 2024: A third of the UK don’t feel comfortable discussing their finances with friends

25 October 2024

| 7 minutes

For many of us, money is something that’s often at the front of mind. And with the cost of living getting higher and higher, it’s something that can be a big worry. Rising costs can cause us to reprioritise our outgoings, cutting back on discretionary expenses to manage our budget more effectively.

It’s no secret that feelings around money are heightened. That’s why, here at ALA Insurance, we wanted to find out exactly how comfortable people are in their financial situation. We also wanted to understand how these feelings affect our attitude to insurance, whether that’s for general insurance policies for homes and cars, or other helpful policies like additional car cover and excess protection insurance.

The ALA Money Survey 2024 surveyed 403 people across the UK to learn more about their feelings towards money and their insurance. From how we talk about finances to friends, to whether we understand how our insurance works, we want to get a sense of our collective attitudes.

How comfortable are the UK with discussing finances?

Here in the UK, talking about money is often considered taboo. Money can be a big worry for many of us, so why don't we want to talk about that with our friends and family?

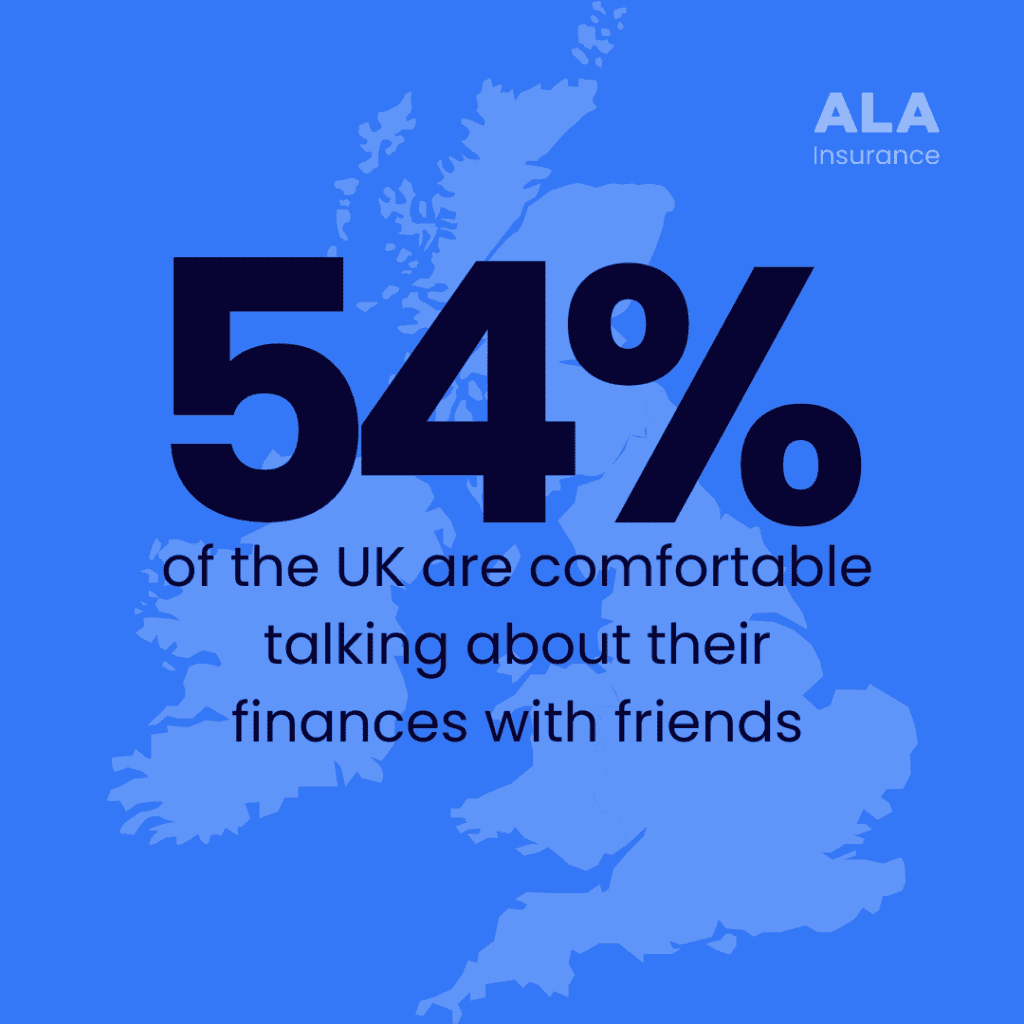

According to our survey, a third of the UK wouldn’t feel comfortable talking about their finances with friends; however, the UK are slightly more willing to talk about money than last year, increasing from 48% to 54%.

This figure is higher amongst older age groups, with 40% of over-45s claiming they wouldn’t feel comfortable discussing their finances with friends. By contrast, only a quarter (27%) of under-45s would feel uncomfortable opening up and discussing their financial situation.

This differs from region to region too. People from the South East and Central England are happier discussing their finances than they were last year.

How does the UK prioritise insurance?

Insurance is arguably one of the most important expenses as it offers protection against unforeseen events and potential financial hardships. However we know that for some, being able to afford insurance in the first place isn’t always easy and unfortunately, it can come with some worries.

Our survey found that the average ranking of financial priorities puts car insurance in fifth place:

| 1 | General bills |

| 2 | Mortgage or Rent |

| 3 | Savings & Investments |

| 4 | Pension |

| 5 | Insurance (car, house, travel etc.) |

| 6 | Debt repayments |

| 7 | Contributing to an emergency fund |

The data shows that in the UK, insurance isn’t a top priority for many people when it comes to managing their finances. It ranks fifth, behind bills, mortgage or rent, savings, and pensions.

While half of people see insurance as more important than pensions and 40% rate it above savings, its overall ranking is brought down by the 26% who consider it the least important. This suggests that while insurance matters to some, it tends to take a back seat to more pressing financial needs, especially for those who might not feel the immediate need for coverage.

Priorities around insurance also differ by group. Women are more likely than men to place insurance above savings or pensions, and younger people (18-24) tend to see insurance as more important than pensions, likely because they’re focused on more immediate concerns. In contrast, older people (45+) tend to prioritise pensions over insurance, reflecting a longer-term view of financial security. This shows how the importance of insurance shifts depending on age, gender, and individual circumstances in the UK.

Why do the UK public cancel insurance policies?

Despite its importance, sometimes we must make the decision to stop an insurance policy. Whether we can no longer afford it or we don’t feel like it’s worth it, there are many factors that can affect our decision.

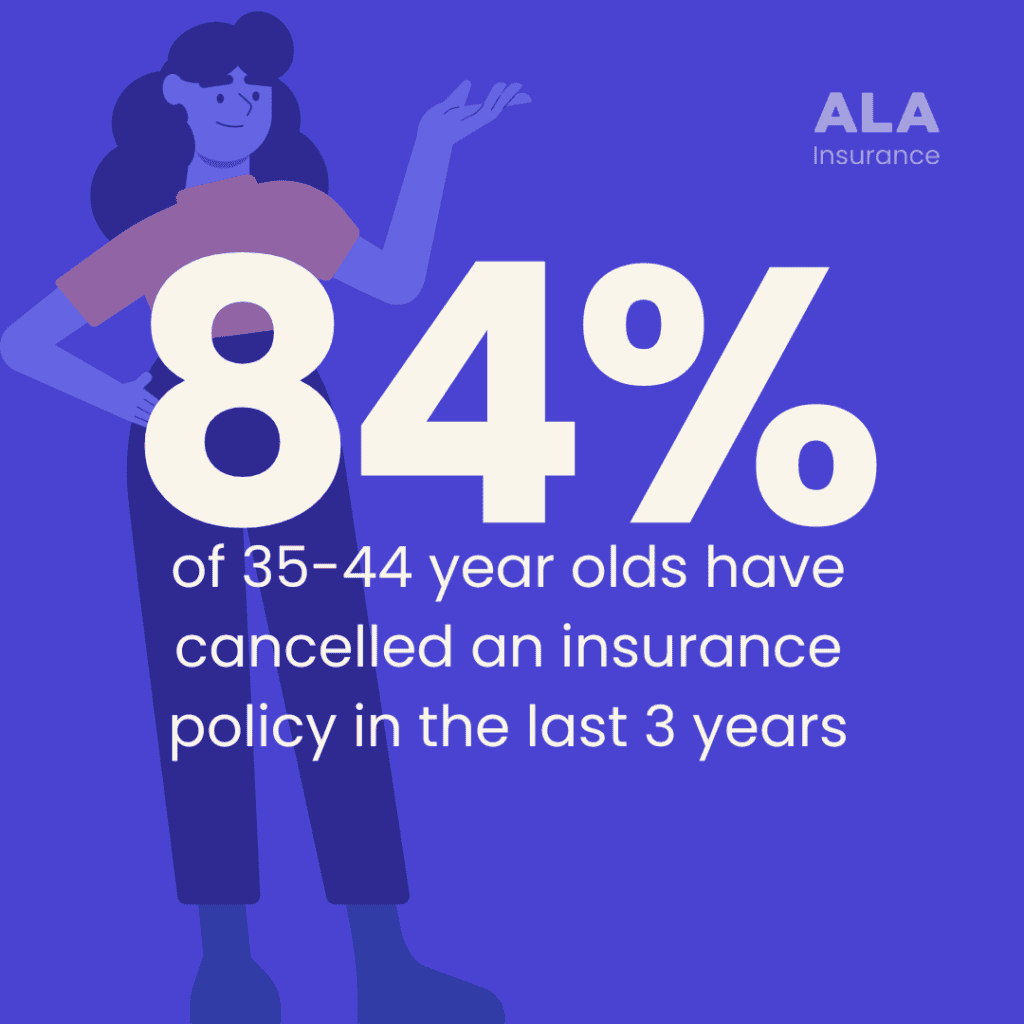

Our survey found that the main reason people in the UK cancel their car insurance policies is due to cost. Over the last three years, 51% of policy cancellations were down to the price being too high, which is almost the same as last year’s 49%. This makes cost the biggest factor by far, nearly double the next reason—poor customer service—which accounts for 27% of cancellations.

People aged 35-44 are the most likely to cancel their car insurance, being twice as likely as other age groups, with 84% of them having cancelled a policy in the last three years, compared to the 62% average for everyone else. Overall, just 35% of people with insurance haven’t cancelled in the last three years, which is a significant drop from the 57% last year. This means cancellations have gone up by 22% compared to the average over the previous few years.

Amid rising costs, only 4% of people have switched insurance providers this year, but a substantial 55% are contemplating making a change. The trend is particularly pronounced among younger individuals, as 65% of those under 45 are considering switching due to financial pressures, compared to just 45% of those aged 45 and over. This indicates that while a small percentage have acted on their dissatisfaction with rising costs, a significant portion of the population is actively exploring their options, especially among younger drivers who are more sensitive to price changes.

There is a significant increase in cancellations due to cost, with the cancellation rate rising 22% year-on-year. The number of people who have never cancelled a policy has dropped from 57% to 35%, showing that financial pressure is leading to more people dropping their policies in 2024 compared to 2023.

Does the UK understand what will void their car insurance?

Many people under 45 think the below offences will not void their car insurance compared to those 45 and over. These figures were similarly poor across the entire age range.

% who think each action can void car insurance by age

| Action | 18-44 | 45+ |

| Driving under the influence of alcohol or drugs | 67% | 88% |

| Failing to report the accident to the insurer within the required timeframe | 73% | 81% |

| Getting into an accident while using the vehicle for commercial purposes without proper coverage | 55% | 84% |

| Driving with an expired licence | 53% | 83% |

| None of the above | 5% | 4% |

In reality, all of the actions listed can potentially void your car insurance in the UK.

If you're caught driving while intoxicated, your insurer can refuse to pay out for any claims, as it is considered illegal and reckless driving.

Most insurance policies require you to report an accident within a certain period. If you fail to do so, your insurer could invalidate your policy and deny any claims related to the incident. If you're using your vehicle for business purposes without the correct insurance cover (e.g., delivery driving), your insurance could be void because you're using the vehicle in a way that's not covered by your policy.

Driving without a valid licence is illegal, and your insurance could be invalidated if you're involved in an accident while your licence is expired.

All of these actions breach the terms of most UK insurance policies and could lead to the insurer refusing to cover any claims or cancelling your policy altogether.

Does the UK understand when the best time to renew their car insurance policy is?

When it comes to renewing car insurance, most people in the UK start looking for quotes about three weeks before their policy expires. In fact, 71% of drivers begin searching for renewal options at least two weeks ahead of time, ensuring they have time to compare prices and secure a good deal.

However, a small percentage are less proactive—4% don't bother looking for new quotes at all and simply let their policy renew automatically, while 7% only check for better options if they receive a reminder. This suggests that the majority are mindful of getting the best price, but a minority take a more relaxed approach.

Luckily, the majority of the UK get this right. The best time to renew your car insurance policy is typically around 3 to 4 weeks before your current policy expires. Research shows that insurers often offer their most competitive rates during this window, as they aim to attract early renewals. Waiting until closer to the renewal date or letting the policy auto-renew can result in higher premiums, as prices tend to rise when the renewal date is imminent. Starting your search 3 weeks ahead gives you enough time to compare quotes and secure the best deal.

What role does the public feel the Government should play in car insurance?

Our data shows a significant generational divide in the UK public’s view on the government’s role in helping with car insurance and vehicle-related costs.

A strong majority (69%) of those under 45 believe the government should provide assistance, compared to just 44% of those aged 45 and over. Among older individuals, resistance to government involvement is more noticeable, with 23% of over-65s actively opposing any intervention.

When it comes to the Autumn Budget, one-third of people under 45 feel reassured and more confident about affording their car insurance next year, whereas only 11% of those over 45 share this optimism. This suggests younger people are generally more open to government support in this area, while older generations are more cautious or sceptical.

Can the UK public afford like-for-like car replacements?

When asked if they could afford a like-for-like replacement vehicle if their car was written off, only 26% of the UK public said they could, even with insurance assistance. In contrast, 32% admitted they wouldn't be able to afford it, and a further 31% said they would face financial strain if they had to replace their car.

This indicates that the majority of people in the UK would struggle to cover the cost of a like-for-like replacement, highlighting the financial challenges many would face in such a situation, even with insurance payouts.

GAP insurance would be important to these people because it covers the difference between the amount their car insurance provider pays out and the amount needed to replace their vehicle with a like-for-like model. For the 32% who cannot afford a replacement and the 31% who would face financial strain, a standard insurance payout may not fully cover the cost of a new vehicle, especially if the car's value has depreciated. GAP insurance ensures they aren't left out of pocket by bridging the gap, making it easier for them to afford a similar replacement without significant financial burden.

How can ALA, as insurance providers, help ease our customers’ financial worries?

We know how that insurance plays a big part in most people’s lives. That’s why at ALA, we believe it’s our duty to not only offer comprehensive coverage, but to foster a feeling of ease and assurance with the policies we offer.

We want to make sure that every customer feels comfortable and confident in the protection they receive. By offering full transparency, we strive to simplify the complexities of insurance, making every detail of a policy clear and accessible. We want to help our customers make informed decisions and trust that we have their best interests at heart.

We know how stressful claiming on your insurance can be. That’s why any ALA GAP insurance customer who has experienced a total loss claim will be eligible for free therapy sessions at no extra cost to the customer and nothing added to our premiums.

To find out more, read more about our ethos or view the insurance policies we offer.