Top 5 regions where men bought GAP Insurance in 2015

2 June 2016

Traditionally, men are thought to be more likely than women to protect their auto investment.

Following last month’s look at the ‘Top 5 regions where women bought GAP Insurance in 2015’, here at ALA GAP Insurance we decided to look at the men’s statistics.

Do the UK’s regional stereotypes hold true for men as well as women?

Discover the unexpected results below.

Regions where customers bought GAP Insurance in 2015

The table below shows the GAP sales figures for 2015, relative to the region’s population.

Looking at the data we can see that men from across the UK are more likely than women to buy GAP Insurance. Apart from North West England coming in fifth for men (Yorkshire came in fifth for women), the Top 5 Regions where Men bought GAP Insurance in 2015 are the same as the women’s top 5. However, once you delve deeper into the statistics, there are disparities to be found.

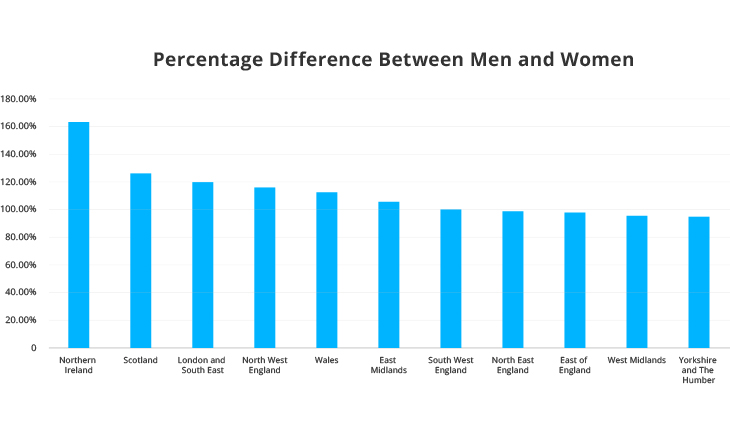

GAP Insurance percentage difference between men and women

N. Ireland GAP Insurance rates among men and women in 2015

The general trends show that men are more likely than women to buy GAP Insurance. However, looking at all parts of the UK, N. Ireland has by far the greatest disparity between the numbers of men and women who bought GAP Insurance in 2015. In fact, the disparity between the sexes was 162.64%, which is roughly 40% more than any other part of the UK.

Scotland GAP Insurance rates among men and women in 2015

The disparity between Scottish men and women buying GAP Insurance sees a drop from 162.64%, to 126.19%. One of contributing factors as to why men purchase GAP Insurance could be car crime. In 2011-2012, central Scotland had an above-average rate of car crime, with 151 offences per 10,000 registered vehicles. Criminal damage made up 57% of all car crime, while theft from a vehicle made up 24% of all offences.

London and the South East GAP Insurance rates among men and women in 2015

The disparity drops further still for men and women in London and the South East, from 126.19% to 119.98%. There are a number of factors that influence male customers to purchase GAP, but for customers in London population and traffic density are undoubtedly among the key factors. These concerns are well founded. London is the car accident capital of the UK, and has the third highest car crime rate.

North West England GAP Insurance rates among men and women in 2015

Not too far behind London is North West England, with a disparity between men and women who bought GAP Insurance of 115.62%. Even though the North West came fifth for overall policies sold to men, it seems male customers in the region are more likely to look to protect their investment than their female counterparts. And with good reason. Manchester has the highest crime rate of any city in the UK and the region has the highest the third highest accident rate in the UK.

Wales GAP Insurance rates among men and women in 2015

Following North West England is Wales, with a disparity of 112.35% between men who bought GAP compared to women in the same area. Even though Wales is sparsely populated and generally has a low crime rate as result, it does have a number of more built-up areas and cities, for example Cardiff, with high numbers of commuters and shoppers. It’s important to note that town rates in Wales are only marginally above the urban average.

Summary

Looking at the data we can see how men who live in regions with a high population density are the most likely to purchase GAP. However, it’s interesting to see that men living in N. Ireland, Wales and Scotland are much more likely to buy GAP than their female counterparts, suggesting car crime and car accidents are much stronger factors for men in those countries than they are for women.

Click here to read more: Statistics ALA Connect.